Kardashian Kard killed - but prepaid cards set to take off

Published 1/6/11 (Modified 3/17/11)  By Peter Andrew

By Peter Andrew

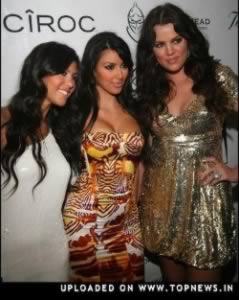

Call me old-fashioned (no, really--everyone else does), but I know next to nothing about the Kardashian sisters. However, even with the tiny amount of knowledge I have, I struggle to picture a family breakfast scene in which Kim, licking maple syrup from her perfectly manicured fingers, glances up from her copy of The Wall Street Journal, and remarks to Khloe and Kourtney: "It says here that analysts are forecasting explosive growth for the prepaid card market. I think we should establish an aggressive presence in that sector."

No, I suspect that some Svengali-like figure on the sisters' business management team persuaded the family that launching the Kardashian Kard was a good idea. And it might be fairer to blame him or her than the girls for the fact that the Kard is likely to end up entering the record books as one of the shortest-lived products in the history of financial services.

Kard killer

The Kard was withdrawn Nov. 30, just three weeks after its glitzy launch. And its cause of death was the sheer weight of negative publicity that followed a blistering attack on it by Connecticut Attorney General Richard Blumenthal. He's quoted as referring to the product's "pernicious and predatory fees," saying, "Among the prepaid debit cards now on the market, the Kardashian Kard is particularly troubling because of its high fees combined with its appeal to financially unsophisticated young adult Kardashian fans. Keeping

Read the full article » By Clark Schultz

By Clark Schultz  By Clark Schultz

By Clark Schultz  By Jim Sloan

By Jim Sloan  By Richard Barrington

By Richard Barrington